coinbase pro taxes uk

Easily deposit funds via Coinbase bank transfer. Interestingly this limit applies to an equivalent amount in all currenciesboth fiat and crypto.

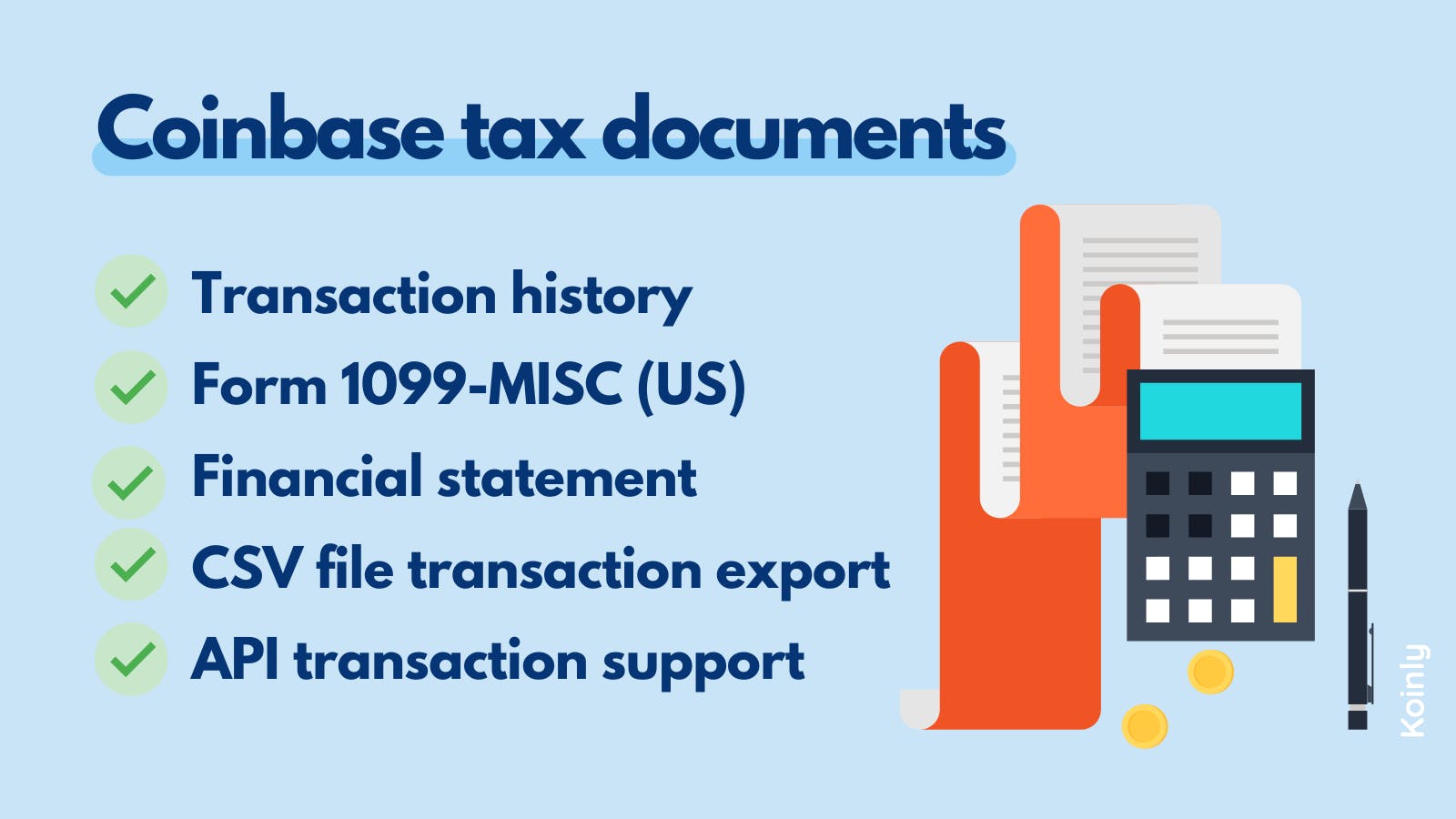

The Complete Coinbase Tax Reporting Guide Koinly

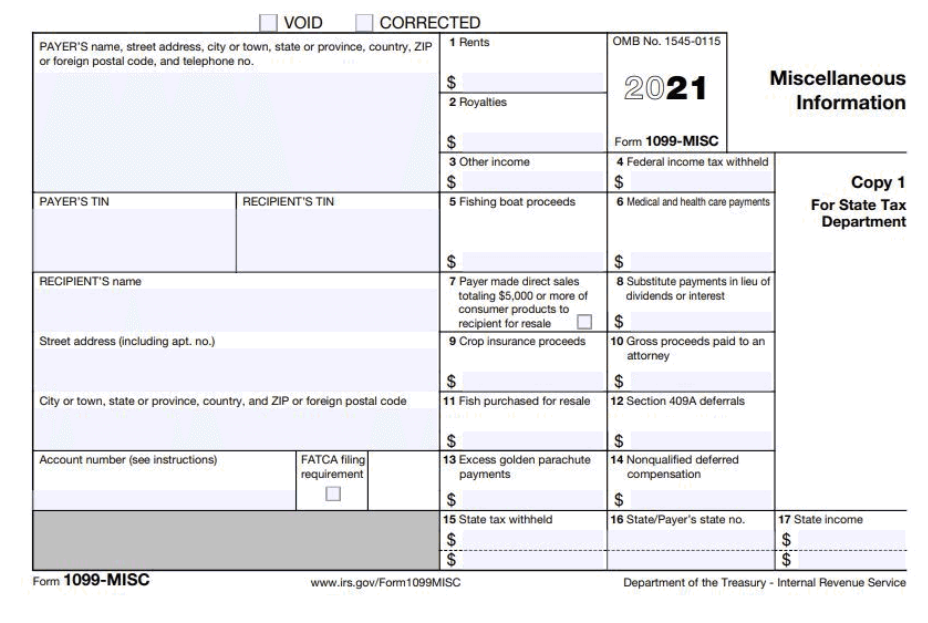

Coinbase does not provide a Form 1099-B like a traditional broker and as of the tax year 2020 will not be providing a Form 1099-KIt does provide a Form 1099-MISC on the.

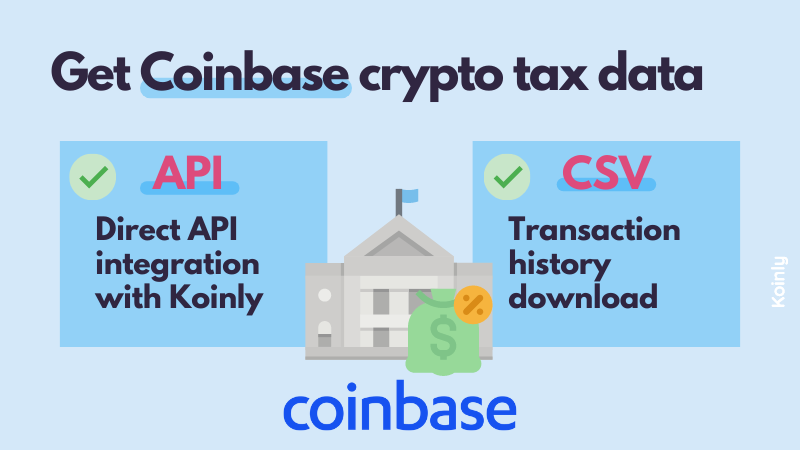

. Visit Coinbase Pro API page. Coinbase Pro wont be able to monitor your cost basis and compute your total crypto tax burden if you. If youre a Coinbase Pro user looking to file your crypto taxes look no further than this Coinbase Pro tax guide.

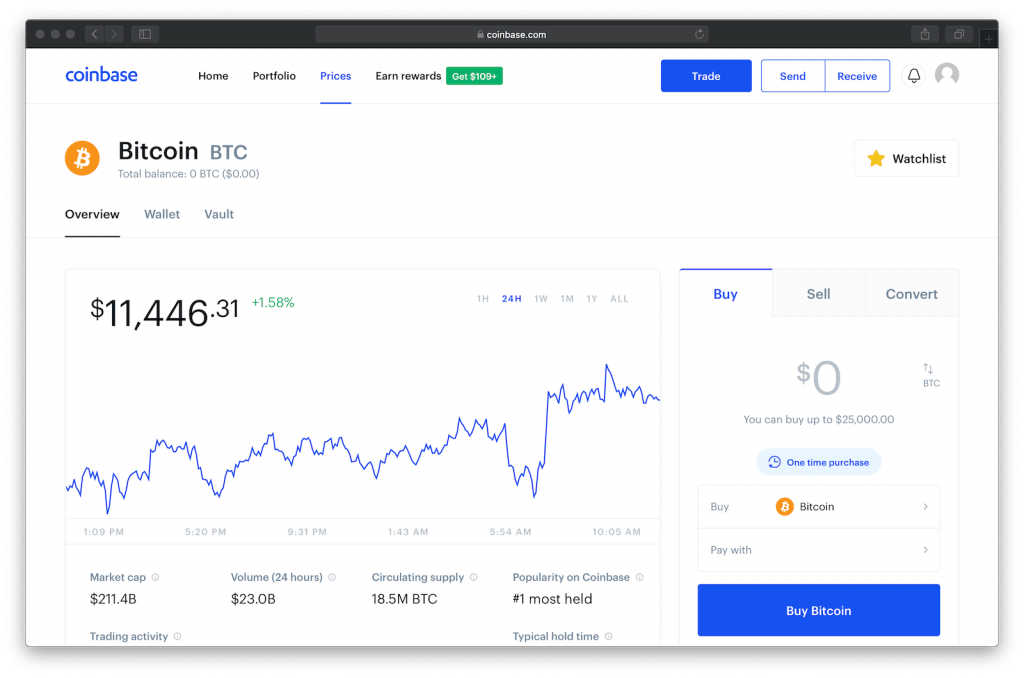

If you are a Coinbase Pro customer and you meet their thresholds of more than 200 transactions and 20000 in gross proceeds then you will receive the IRS Form 1099-K. Coinbase Tax Resource Center. Trade Bitcoin BTC Ethereum ETH and more for USD EUR and GBP.

To the right click on the button called. You pay taxes on profit which happens at the moment of a sale not on the money you decide to keep here or there. Click Create API Key.

The starting Coinbase Pro withdrawal limit is 50000 per day. Log in to Coinbase Pro click on My Orders and select Filled. Coinbase Pro for example can only see transactions that take place on their platform.

Under Permissions select View. Leave the IP whitelist blank. Coinbase Pro is Coinbases.

Make sure All time All assets and All transactions are selected. Choose a Custom Time Range. Click on Generate Report next to Transaction History.

Support for FIX API and REST API. Your guide to cryptocurrency tax terms in the US. Within CoinLedger click the Add Account button on the top left.

Select Product orders you want to import. Click on Download ReceiptStatement. Users of the Coinbase exchange to own more than 5000 in cryptocurrency in the UK are going to have the details sent over to the HMRC.

In the navigation bar at the top right click on the account icon and select Statements from the dropdown. Coinbase Pro features advanced charting features and a huge range of crypto trading pairs - making it an ideal exchange for more experienced crypto traders. Click New API Key.

Copy the Passphrase and paste into CoinTracker. The interesting thing about this is that. If this is your first time dealing with crypto as part of your tax returns were here to help.

Find Coinbase Pro in the list of supported exchanges and select the import method you prefer. 2021-2022 Crypto Tax Glossary. Sign in to Coinbase Pro.

Cost Basis What Is It And How It Can Help You Calculate Your Crypto Taxes Coinbase

Get Your Tax Refund Into Coinbase When You File With Turbotax By Coinbase The Coinbase Blog

The Complete Coinbase Tax Reporting Guide Koinly

The Coinbase Mission Vision Strategy Open House Mission Strategies

![]()

Using Turbotax Or Cointracker To Report On Cryptocurrency Coinbase Help

Crypto Unicorn Taxbit Joins Forces With Paypal Coinbase Ftx And More To Make Paying Bitcoin And Nft Taxes A Whole Lot Easier

Coinbase 1099 What To Do With Your Coinbase Tax Documents Lexology

Uk Cryptocurrency Tax Guide Cointracker

The Complete Coinbase Tax Reporting Guide Koinly

Coinbase Vs Coinbase Pro What The Difference Crypto Pro

Coinbase Debit Card Tax Guide Gordon Law Group

14 Best Crypto Tax Software To Ease Your Calculation And Be Compliant Geekflare

Coinbase Resources For 2019 Tax Returns By Coinbase The Coinbase Blog

The Complete Coinbase Tax Reporting Guide Koinly

Reflections On Bitcoin Transaction Batching Bitcoin Transaction Bitcoin Reflection

Market Efficiency Of Gold And Bitcoin Business Blog Bitcoin Bitcoin Market

![]()

Uk Cryptocurrency Tax Guide Cointracker

How To Sell Withdraw From Coinbase Bank Transfer Paypal Youtube